The Ultimate Guide To Clark Wealth Partners

Clark Wealth Partners Things To Know Before You Buy

Table of ContentsA Biased View of Clark Wealth PartnersNot known Factual Statements About Clark Wealth Partners 6 Simple Techniques For Clark Wealth PartnersNot known Facts About Clark Wealth PartnersEverything about Clark Wealth Partners

Just placed, Financial Advisors can handle component of the duty of rowing the watercraft that is your economic future. A Financial Consultant must collaborate with you, except you. In doing so, they must work as a Fiduciary by placing the very best passions of their clients above their own and acting in good confidence while giving all pertinent truths and avoiding conflicts of passion.Not all connections are successful ones. Prospective negatives of functioning with a Financial Expert include costs/fees, quality, and prospective desertion.

Genuinely, the goal should be to really feel like the guidance and solution obtained deserve more than the expenses of the connection. If this is not the situation, then it is an adverse and hence time to reassess the partnership. Cons: Top Quality Not all Economic Advisors are equivalent. Equally as, not one expert is perfect for each possible customer.

Getting My Clark Wealth Partners To Work

A customer should always have the ability to address "what occurs if something occurs to my Financial Expert?". It starts with due diligence. Always appropriately veterinarian any kind of Financial Advisor you are considering working with. Do not depend on promotions, awards, credentials, and/or referrals entirely when seeking a partnership. These methods can be utilized to narrow down the pool no doubt, yet after that gloves need to be placed on for the remainder of the work.

when speaking with advisors. If a details area of experience is required, such as working with exec comp strategies or setting up retirement for local business proprietors, find consultants to meeting who have experience in those arenas. Once a relationship begins, stay bought the connection. Dealing with an Economic Advisor must be a partnership - civilian retirement planning.

It is this sort of initiative, both at the begin and with the partnership, which will certainly assist highlight the benefits and ideally reduce the drawbacks. Really feel totally free to "swipe left" numerous time before you ultimately "swipe right" and make a solid connection. There will certainly be an expense. The role of a Financial Advisor is to aid clients develop a plan to fulfill the monetary goals.

It is vital to understand all charges and the framework in which the advisor runs. The Financial Consultant is liable for offering worth for the costs. http://localbrowsed.com/directory/listingdisplay.aspx?lid=96270.

See This Report on Clark Wealth Partners

You require it to know where you're going, exactly how you're obtaining there, and what to do if there are bumps in the road. An excellent monetary expert can place together a thorough plan to assist you run your organization much more successfully and prepare for anomalies that develop - https://www.callupcontact.com/b/businessprofile/Clark_Wealth_Partners/9885243.

Lowered Stress and anxiety As an organization proprietor, you have lots of things to stress about. A good economic consultant can bring you peace of mind knowing that your funds are getting the attention they require and your money is being spent sensibly.

Third-Party Perspective You are completely bought your service. Your days are loaded with choices and worries that affect your firm. Often company proprietors are so concentrated on the daily grind that they forget the large photo, which is to earn a profit. A monetary advisor will certainly consider the general state of your finances without getting feelings included.

About Clark Wealth Partners

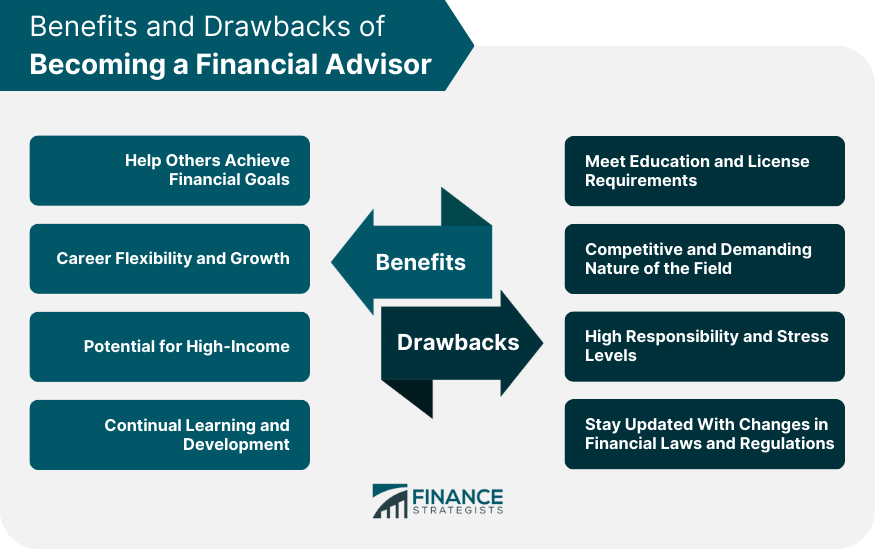

There are many pros and cons to take into consideration when employing an economic advisor. Advisors offer personalized techniques customized to individual goals, possibly leading to better monetary end results.

The cost of employing an economic advisor can be considerable, with costs that might impact general returns. Financial preparation can be frustrating. We advise talking to a monetary expert. This totally free device will certainly match you with vetted experts who serve your area. Right here's exactly how it functions:Address a couple of easy questions, so we can find a suit.

It only takes a few minutes. Check out the advisors' profiles, have an introductory phone call on the phone or intro personally, and select who to deal with. Discover Your Advisor People turn to economic experts for a myriad of factors. The possible advantages of employing an advisor include the know-how and understanding they use, the individualized recommendations they can supply and the long-lasting discipline they can infuse.

The 3-Minute Rule for Clark Wealth Partners

Advisors are experienced professionals that remain updated on market patterns, financial investment strategies and monetary laws. This understanding allows them to give insights that may not be conveniently apparent to the typical individual - https://harddirectory.net/Clark-Wealth-Partners_332044.html. Their know-how can aid you browse intricate monetary circumstances, make notified decisions and potentially surpass what you would certainly complete on your very own